Pharmacy Benefit Managers

Pharmacy Benefit Managers

New car shopping is fun. That true new car smell is intoxicating. Sitting in a brand-new car that very few people have ever driven is quite the rush. But that is where the fun ends. To own that new car, you must go through the buying process. And most of us are sure we will be coming out on the losing side of the deal.

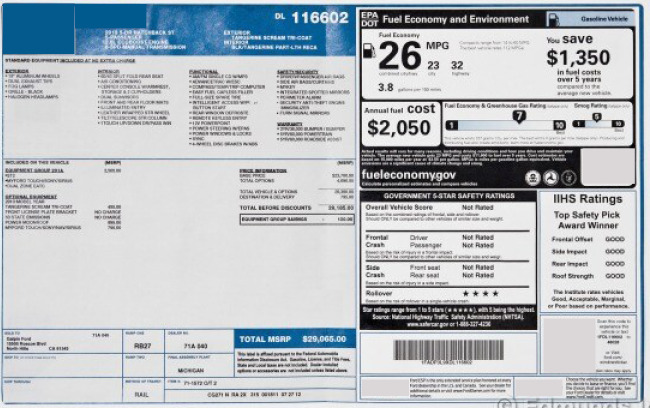

The car dealer that sells you a car is a middleman. He is the step between you, the buyer, and the manufacturer. And as middlemen are, they are eager to get their share of the profit of the sale. In the car world, that means they buy cars from the manufacturer at a discounted price, raise the price to the consumer, then offer “specials” to make people believe that they are getting a deal, or saving money on the vehicle of their choice. By the end of the sale, the dealer has, if not more, at least doubled their money.

The concept holds true for workers’ compensation programs as well. Pharmacy Benefit Managers (PBMs) are third-party companies that function as the middleman between insurance providers and pharmaceutical manufacturers. PBMs create a list of approved prescription drugs under a benefit plan, negotiate prices with manufacturers, process claims, create pharmacy networks and conduct drug utilization reviews.

Beginning in the 1960s, insurance companies offered prescription drugs as a health plan benefit. As the demand for drug benefits on health plans grew, PBMs evolved to support workers’ compensation mail-order drug programs. By 1990, the service expanded to the retail pharmacy.

It was then that PBMs were created to help insurers contain drug spending. PBMs originally decided which drugs would be offered in formularies and administered drug claims. The 1970s saw some changes in the industry and PBMs began to adjudicate prescription drug claims. In the 1990s, drug manufacturers began acquiring PBMs, leading to concerns about conflicts of interest which led to federal orders for divestment from the Federal Trade Commission and sparking a trend of mergers and acquisitions within the PBM field.

As health care costs rise, the role of PBMs as prescription reviewers has come under fire. This is due to the cost of prescription drugs and the effects on consumers. The cost of insulin and EpiPens, for example, became a hot topic news story before the COVID pandemic, as patients began having to ration medicine when they were not able to afford rising copays.

At this point in the field, it became clear that one way many Pharmacy Benefit Managers earn their profit is through administrative fees charged for their services, through spread pricing – that is the difference between what is paid to pharmacies and the negotiated payment from health plans – and shared savings where the PBM keeps part of the rebates or discounts negotiated with drug manufacturers. This has caused concerns with PBM business practices, focusing on transparency to consumers regarding rebates and reimbursements.

MC Innovations has partnered with a nationally recognized PBM to offer the industry’s first Transparent Pharmacy Pricing program (TPP). This allows clients to better understand both drug prices and the often-undisclosed associated TPA fees. Thinking in terms of buying a car, an example that parallels the PBM situation, we often don’t know what the dealership paid for a car, making it impossible to determine the quality of any deal struck. Additionally, MCI’s PBM partner brings a new world of technology to the PBM market, which is designed to assure a higher quality of drug treatment care for the injured worker.

Find out more about how our Pharmacy Pricing Services can help your organization today.

Managed Programs... Managed Better

Experts in Risk

Management Consulting

Address

5540 Falmouth Street

Suite 203

Richmond, VA 23230