Chapter 2 – The Importance of Transparent Pricing

Chapter 2 - The Importance of Transparent Pricing

Now that you have picked out the perfect car, all that is left is to sign on the dotted line. So why is the car salesman happier than he has been throughout the whole process? Then you look at the bottom-line price. It is a far cry from the sticker price. Why is that? In a few words…undisclosed fees!

Car dealerships are not the only place where undisclosed fees can add up quickly. Third-Party Administrators (TPAs) have adopted similar practices. Over the years, TPAs have figured out how to make their bottom-line price appear lower than what it is. In fact, some TPAs use their ancillary services as an additional source of undisclosed revenues. These services may include bill review, telephonic and field case management, Pharmacy Benefit Management (PBM), Independent Medical Exams, diagnostic services, and surveillance. These services, undoubtedly, have enhanced the quality of the claims service. However, a deeper look into accounting and payment processes can prove to be problematic: undisclosed TPA revenues.

Today the workers’ compensation environment presents an evaluation problem. The administrative fee (unallocated expense) is generally the proposed bid price while the allocated administrative expenses such as medical expenses are paid from funds dedicated to paying direct claims cost. These are two separate and distinct funding sources for workers’ compensation and must not be intermingled.

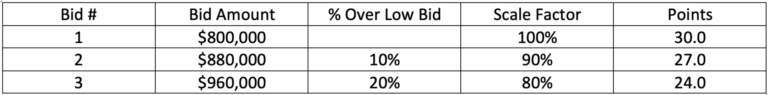

Assume three proposals are submitted in response to an RFP and ranked from the lowest to highest bid:

A typical RFP award can be based on a 100 points with 30% of these points distributed based on the bidder’s price scale factor. The low bidder receives 30 points and the next lowest bidder will receive 10% fewer points (27) and the highest bidder is penalized 20% with 24 points.

If the two low bidders had identical administrative cost but the low bidder was able to retain, without the employer’s knowledge $200,000 from PBM payments, the bid price is understated. By adding the $200,000 to the $800,000 bid, the price charged by the TPA is $1,000,000. This change is dramatic. Without pricing transparency, what is essentially a high bid of $1,000,000 became an employer subsidized winning low bid of $800,000.

In essence, the employer selected the high-cost bidder.

WHAT YOU SEE IS NOT NECESSARILY WHAT YOU GET. How can this duplicity occur?

Assume the TPA has negotiated a PBM discount off AWP of 35%. In turn, the TPA offers the employer a PBM 20% discount, thereby collecting an “invisible” fee of 15% of AWP from the employer. This can be used to offset a portion of the administrative bid fee. If questioned by the employer, the TPA may state that the “invisible” fee is used to offset operating expense and therefore is of no consequence. Regardless, the TPA is understating the administration fee to gain a $200,000 pricing advantage.

The practice corrupts the competitive bidding process.

The employer pays the winning bid of $800,000 plus an undisclosed fee of $200,000 or $1,000,000, an increase of 25% above the bid price. This $1,000,000 fee is 11.3% over Bid #2 and 4.2% over Bid #3. The lack of pricing transparency is costly to the employer and biases the decision results.

How do you fix the problem? As discussed in our previous PBM Blog, pricing transparency is vital for the proper allocation of the employer’s resources.

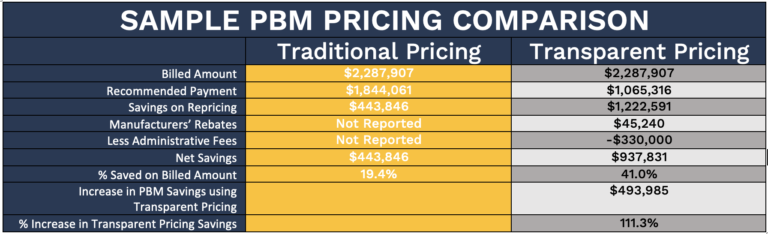

Below is a comparison of traditional TPA pricing compared to Transparent Pricing:

Critical items in this chart include:

- Identical billing amounts

- Manufacturer rebates not returned to the employer by the TPA

- Administrative fees not reported by the TPA

The bottom line – the employer gains $493,985 in additional savings, an increase in savings of 111.3%

The result – the pricing transparency model results in additional savings of $493,895. One wonders who is getting the $493,895; it is certainly not the employer.

This example presented also applies to a self-administered program directly contracting with a PBM.

Chapter 3 forthcoming will complete our PBM Story – Don’t Miss IT!

Managed Programs... Managed Better

Experts in Risk

Management Consulting

Address

5540 Falmouth Street

Suite 203

Richmond, VA 23230